We’ve discussed groundwater several times on our blog and educational series. We’ve discussed how to find it and shared a few successful cases of finding it with ERI techniques. We’ve also compared 1D, 2D, and 3D survey types in a previous blog post. This time, we want to combine the two topics. All three survey types can look into the subsurface, but which type will help you find groundwater the most effectively? That’s what we’re here to answer.

What would count as successful groundwater exploration?

First, we need to detail what constitutes successful groundwater exploration before comparing. We’re sure that the first metric you may think of is cost. Yes, keeping the costs down for your groundwater exploration is part of a successful project. Prices can be kept in check with the type of equipment you use, the speed of your survey, and the accuracy of your data.

Speaking of accuracy, the next success metric is an obvious one—locating groundwater. No one wants to spend the time and money it takes to do a groundwater exploration project and not find water. The accuracy of the location is essential as well. As you’ll see below, each survey type interprets data differently. Some interpretations are more accurate than others. As you’ll see—successful groundwater exploration isn’t just about locating groundwater. Furthermore, accurately discerning the salinity of the groundwater is essential—especially if you’re looking for potable water.

Although location is critical, our experience shows us that abundance can be the most important metric. If you’re looking for groundwater, you’re most likely looking to use that water source for a long time. If so, you’ll want to tap into a substantial aquifer and not a small water-filled void. Knowing the distribution of a potential aquifer informs drilling locations and cuts down on the costs of drilling unnecessary holes.

Which survey type fulfills all three metrics?

Blue = Meets the metric, Yellow = Meets the metric, with considerations, Red = Does not meet the metric

| Survey Type | Metric 1: Cost | Metric 2: Location & Accuracy | Metric 3: Distribution Potential & Salinity |

|---|---|---|---|

| 1D | A 1D system is the lowest-cost resistivity system in terms of the sticker price. However, you may need more working hours and have to drill several holes due to 1D data limitations. Consequently, you may still end up with dry holes after. | A 1D survey can technically locate water-containing layers, but 1D data cannot provide accurate drilling locations. | A 1D survey can not tell you the distribution of a potential aquifer of the groundwater in the subsurface. It’s challenging to see salinity with 1D data. |

| A Single 2D Line | A 2D system costs more than 1D but less than a 3D system. Using only a single line of 2D data will not cost much time but will likely result in drilling several dry holes. | A single 2D survey line can find geologic scenarios often associated with groundwater. 2D data is still an approximation of 3D space and may most likely direct you to dry holes due to offline anomalies of 2D data. | A single line of 2D data can give you a tiny hint at the distribution of a potential aquifer, but too much is open for interpretation for it to be a viable solution. 2D data may let you interpret water salinity. |

| Linear-Measured 3D | The same sticker price as a 2D system because you’re using a 2D system for the survey. The difference is that you will measure several parallel lines in a row (at a maximum of twice the electrode spacing). This procedure will cost more survey time. However, the increase in data acquisition results in less drilling. | Linear-measured 3D surveys can locate groundwater and can significantly improve accuracy over 1D and single-line 2D. The improvement is because you’re getting several parallel images which creates a greater approximation of a 3D image. | A linear-measured 3D survey can give you an approximate notion of the distribution of a potential aquifer and give you enough data to discern water salinity. |

| True 3D | A 3D system is the highest sticker price and survey time. However, the precise data you receive will result in less drilling. | A 3D survey will give you the most high-resolution data to find the exact locations of groundwater resources. | A 3D survey will provide you with a clear image of the distribution of a potential aquifer of water in the subsurface and enough data to discern water salinity. |

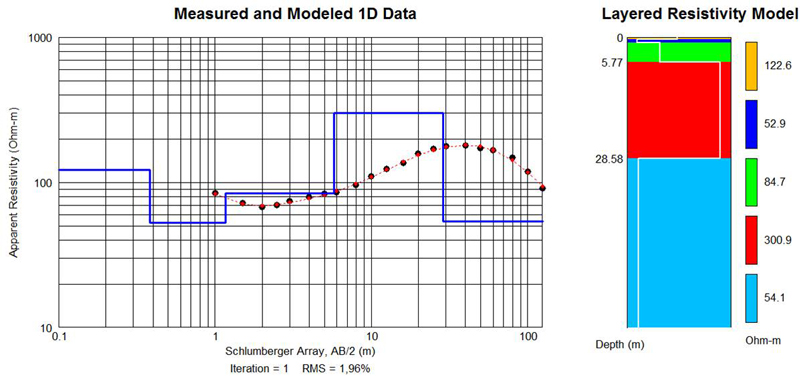

A common misconception is that since all three survey types can perform subsurface surveys, then 1D is the most affordable solution. This isn’t the case because of what we know about 1D survey data. 1D surveys always assume that the geological layers you’re looking at are horizontal and homogenous (which we know is highly unlikely). Because of this, it’s nearly impossible to get an accurate read of the exact location and distribution of a potential aquifer. And remember, knowing this will result in less drilling overall.

Example of 1D data (taken from this case history)

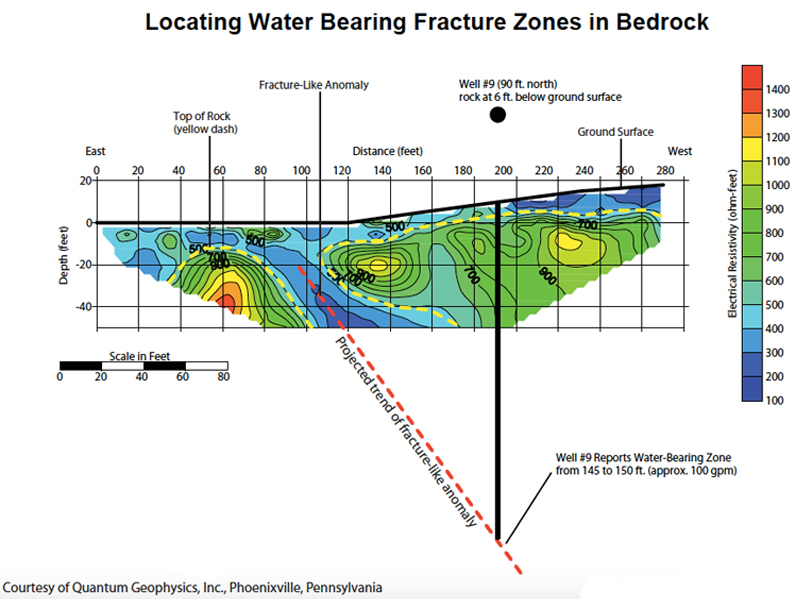

Standard 2D fares a bit better than 1D—but there is still a lot open for interpretation. Instead, the better solution is to do multiple 2D lines (Linear-Measured 3D) to get a 3D image.

Example of 2D data (taken from this blog post)

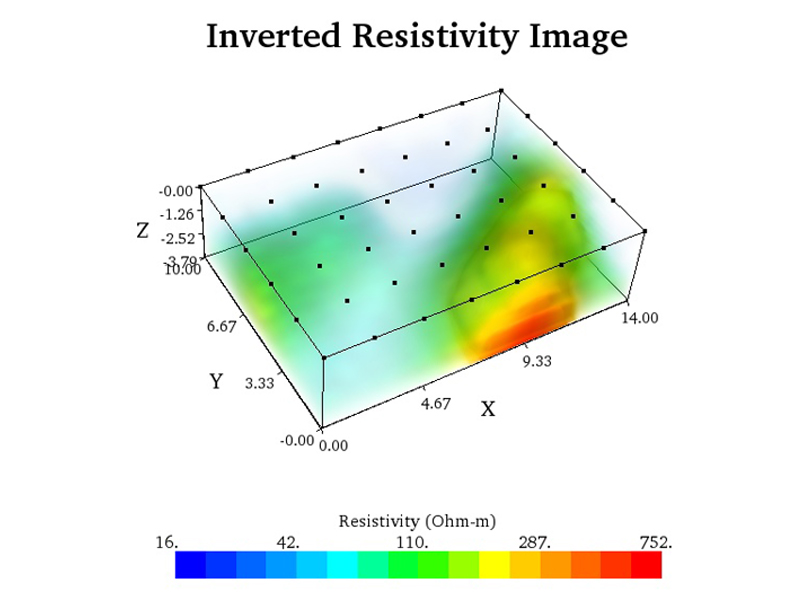

Finally, true 3D is the most expensive, but it beats out all other survey types in terms of data clarity. The only other survey type we can consider on par is a linear-measured 3D survey.

Example of 3D data (taken from this case history)

Conclusion

We recommend doing a linear-measured 3D survey if you’re planning a groundwater exploration project. The costs you pay for the ERI equipment will allow you to save money on the most expensive aspect of the project—which is drilling.